Thanks to Square’s $39 billion bid for Afterpay, there are few markets as hot as the buy now pay later space, but one Melbourne investment group bought in just in the nick of time.

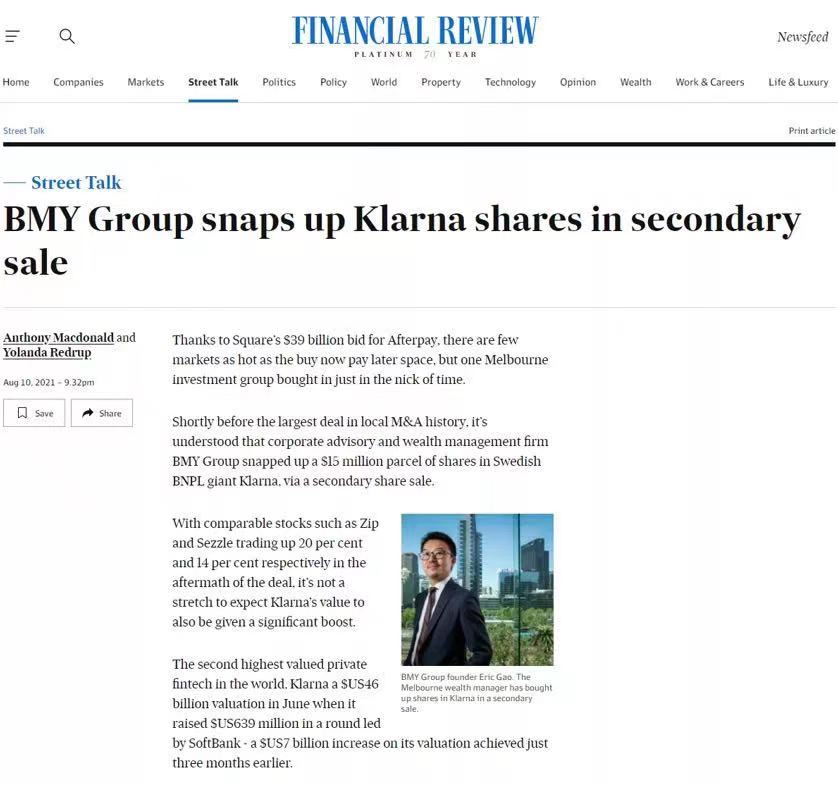

Shortly before the largest deal in local M&A history, it’s understood that corporate advisory and wealth management firm BMY Group snapped up a $15 million parcel of shares in Swedish BNPL giant Klarna, via a secondary share sale.

With comparable stocks such as Zip and Sezzle trading up 20 per cent and 14 per cent respectively in the aftermath of the deal, it’s not a stretch to expect Klarna’s value to also be given a significant boost.

The second highest valued private fintech in the world, Klarna a $US46 billion valuation in June when it raised $US639 million in a round led by SoftBank – a $US7 billion increase on its valuation achieved just three months earlier.

On Tuesday CBA announced that its business customers who switch on Klarna will pay no merchant fees for six months, in an attempt to help the fintech catch up to Afterpay.

The investment from BMY Group, which has the backing of a range of high net worth Chinese investors living in Australia, will have scored it only a tiny fraction of the company, but with an IPO expected to be in the works, that tiny fraction could still net it a nice return.

BMY Group has also backed the likes of artificial intelligence-powered credit risk management software company Rich Data Corporation.

Its investment in Klarna comes after the European BNPL player is widely expected to have made its own investment down under in Zip.

Article sourced from: https://www.afr.com/street-talk/bmy-group-snaps-up-klarna-shares-in-secondary-sale-20210810-p58hk5