BMYG Financial Group (hereinafter referred to as “the Company”) wishes to inform the public of its recent discovery of individuals misusing the name of the Company and impersonating the Company’s staff to illegally sell financial products within and outside Australia. This illicit activity has caused serious harm to the legitimate rights and interests of the Company and investors. The Company hereby issues this formal notice to remind investors of the following:

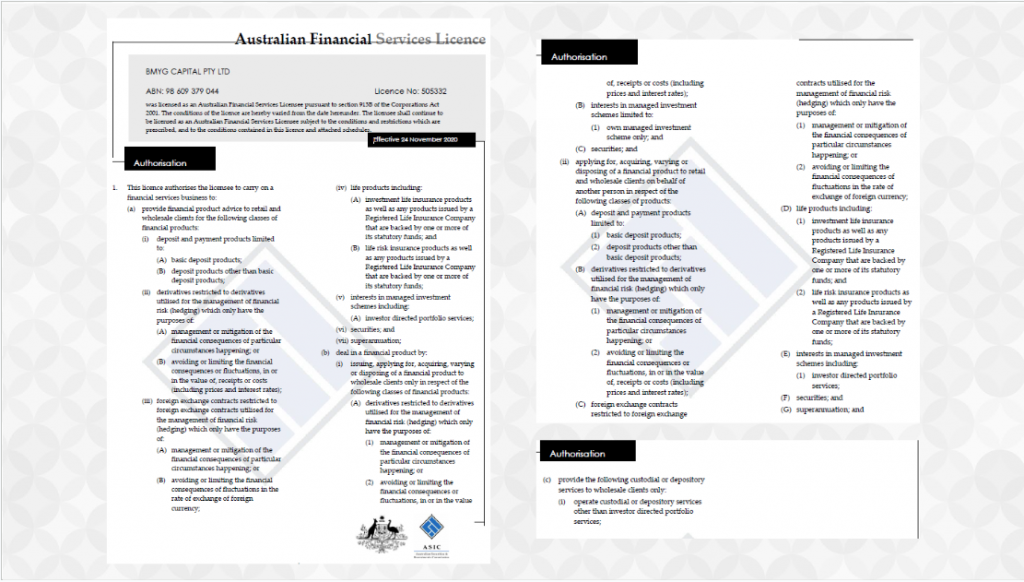

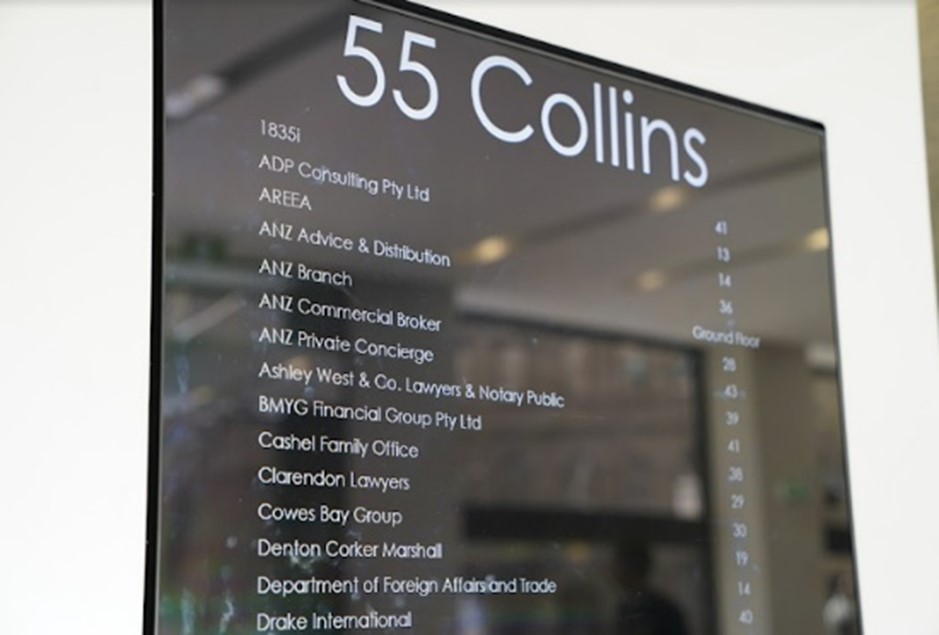

- BMYG Financial Group holds Australian Financial Services License (AFSL) No.505332 and is a fund management and wealth management company regulated by the Australian Securities and Investments Commission (ASIC). Its range of businesses includes fund management, wealth management, and trustee service. The Company has offices in Melbourne and Sydney, Australia as follows:

- Melbourne CBD Office: Level 41/55 Collins Street, Melbourne VIC 3000

- Melbourne Box Hill Office: Level 5/990 Whitehorse Road, Box Hill VIC 3128

- Sydney CBD Office: Level 39/225 George Street, Sydney NSW 2000

- The Company’s joint venture subsidiary, BoMan RichLink Capital, holds a financial services license issued by the Securities and Futures Commission of Hong Kong and can provide securities and asset management services to investors. BoMan RichLink’s Hong Kong team boasts a strong board of directors and operates a comprehensive investment and asset management business in Hong Kong. The office address of BoMan RichLink in Hong Kong is: Room A02, 29/F, United Centre, 95 Queensway, Admiratly, Hong Kong

- The Company’s subsidiary, ALLFIN®, is Australia’s first financial full-media platform and is currently published on seven major global social media platforms. Its total number of users exceeds 150,000, and its accounts include: WeChat Official Account @澳财、WeChat Service Account @澳洲财经、YouTube @澳财网、Red @澳财、Toutiao @澳财网、Xueqiu @澳财网、Xigua Video @澳财网

- The Company has a representative office in Beijing, China.

- The official website of the Company is www.bmyg.com.au, and its customer service phone number is 1300 226 666 or +61 3 8623 7999. Its customer service email is info@bmyg.com.au.

The Company strongly advises investors to exercise utmost vigilance, to carefully identify all communications, and to protect their legitimate rights and interests. Investors are urged to be aware of and guard against being deceived. If any abnormal situation is found, such as the misuse of the name of “BMYG Financial Group” or “BMYG Financial Group” staff, please contact us directly for confirmation by calling 1300 226 666 or +61 3 8623 7999.

The Company reserves the right to take legal action and pursue legal liability against any individual or organization that misuses the name of BMYG Financial Group or the Company’s staff in any way.

This formal notice is hereby issued by BMYG Financial Group on May 12, 2023.